US stocks climbed on Tuesday, following sharp gains in Europe, leaving Wall Street’s benchmark barometer within touching distance of the all-time high it set before the coronavirus-induced market tumult.

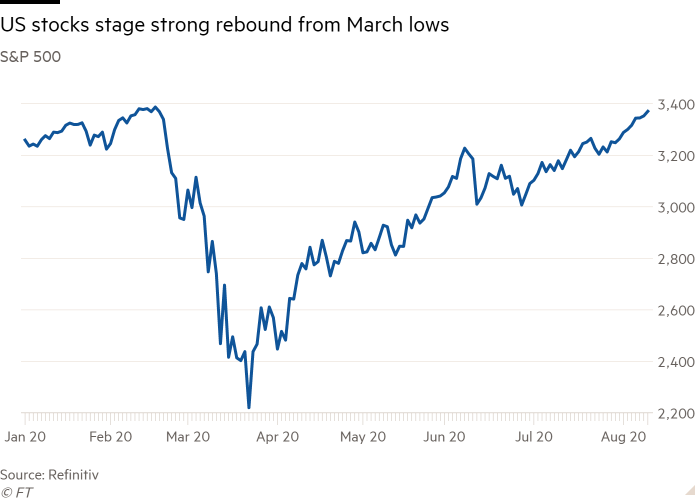

The S&P 500 rose 0.5 per cent at the start of trading to about half a per cent below the peak it reached in February, before Covid-19 fears gripped American and global markets. The tech-heavy Nasdaq, which hit a fresh record high on Friday, slipped 0.3 per cent.

The gains in the US followed a broad advance in Europe, with the continent-wide Stoxx 600 rising 2 per cent and London’s FTSE 100 up 2.1 per cent. MSCI’s broad index of markets in Asia advanced 1.1 per cent.

Market confidence has been bolstered by a barrage of monetary and fiscal stimulus as well as rising hopes for an effective Covid-19 vaccine. Russia on Tuesday said it had approved its vaccine for use beyond clinical trials, while potential immunisations being developed by big drug companies around the world have shown promise.

Goldman Sachs has forecast that the main US drug regulator will approve a Covid-19 vaccine before the end of 2020. Rachel Winter, associate investment director at wealth adviser Killik & Co, said Russia’s announcement “reminded people that a vaccine is on the way”.

Shares in travel companies, which have been beaten down as coronavirus has caused a collapse in demand, were among the top performers on Tuesday. Cruise operator Carnival and British Airways parent International Airlines Group climbed 8 per cent and InterContinental Hotels advanced 4 per cent.

Investors shifted away from assets considered to be havens during times of uncertainty. US government debt came under selling pressure, leading the 10-year Treasury yield to rise by 0.06 percentage point to 0.63 per cent. The yield on German 10-year Bunds also rose by a similar margin.

The US dollar index, a measure of the greenback against half a dozen peers, fell 0.2 per cent. Gold slipped 3.7 per cent to below $2,000 a troy ounce, taking its losses to almost 6 per cent since hitting an all-time high on August 6.

Investors have remained cautiously optimistic that US lawmakers will overcome gridlock in Congress to pass a fresh support package that could further cushion the economic blow from Covid-19. Jan Hatzius, chief US economist at Goldman, said it appeared Republicans and Democrats were “no longer all that far apart”.

Mr Hatzius expects lawmakers to agree by September a fiscal package worth $1.5tn. “This would keep fiscal policy sufficiently supportive to sustain the economic recovery,” he said.

US president Donald Trump added to the upbeat mood by saying late on Monday his administration was “seriously” considering a capital gains tax cut along with other measures to ease Americans’ tax burdens.

US markets have posted an extraordinary rebound from the lows hit during the darkest days of March, with the S&P 500 having soared 50 per cent from its trough. The gains on Wall Street, led by America’s tech titans Apple, Amazon, Microsoft and Alphabet, have outpaced major equities markets in Europe and Asia.

The global economic picture has also proved to be somewhat brighter than some investors had feared several months ago, said Klaus Baader, global chief economist at Société Générale. “The contraction in GDP has been quite a bit smaller than many had expected or feared,” he said.

A survey of investors by research institute Zew recorded a surprise jump this month in confidence in Germany’s economic recovery, according to data released on Tuesday.

Mr Baader said the global economic recovery was on course to be a “truncated V-shaped” and would be supported by ample stimulus measures from governments and central banks.

Oil prices were higher, with the International Energy Agency set to make its forecasts on US oil production later on Tuesday. Brent crude, the international benchmark, rose 1.3 per cent to $45.56 a barrel. West Texas Intermediate, the US marker, climbed 1.8 per cent to $42.71 a barrel.

"peak" - Google News

August 11, 2020 at 08:52PM

https://ift.tt/3ixNLHL

Wall Street stocks near record peak after rally in Europe - Financial Times

"peak" - Google News

https://ift.tt/2KZvTqs

https://ift.tt/2Ywz40B

Bagikan Berita Ini

0 Response to "Wall Street stocks near record peak after rally in Europe - Financial Times"

Post a Comment