US stocks are set to build on record highs as investors respond to last week’s strong jobs data and await a key report that is expected to show that activity in the sprawling American services industry has gathered pace.

Futures tracking the blue-chip S&P 500 index climbed around 0.5 per cent in early New York dealings, with those following an index of the biggest 100 stocks on the Nasdaq Composite advancing 0.4 per cent.

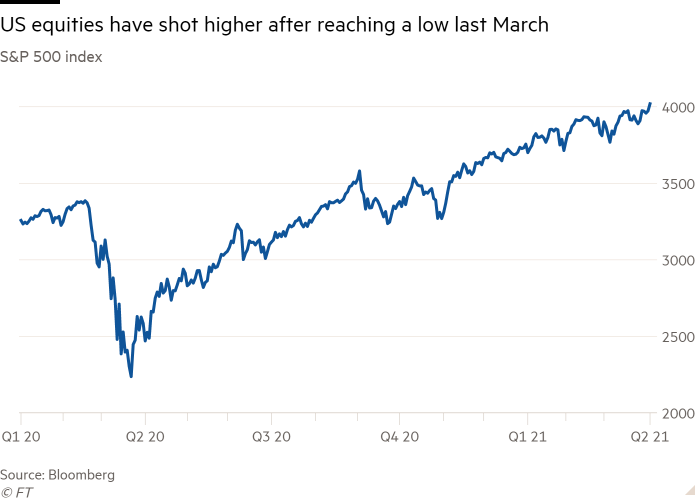

The upbeat start to the week came after the S&P 500 last Thursday closed above 4,000 for the first time. New York equities were shut for the Good Friday holiday the following day.

Equity traders will on Monday have their first chance to respond to a report released on Friday that showed the US economy added 916,000 jobs in March, a figure that exceeded economists’ expectations and provided the latest indication the labour market is recovering.

A closely followed report from the Institute for Supply Management, due to be released at 10am ET (3pm BST), is expected to set a similarly optimistic tone. Activity in the vast services sector is forecast to have climbed at a more rapid pace in March than the prior month, echoing a similar survey released last week that covered the factory sector.

The forecast uptick reflects “a rebound from winter storm disruptions in February and a boost from reopening” of the world’s biggest economy, according to economists at Goldman Sachs.

“The pick-up in the long-subdued service sector is likely to continue with the recent pace of vaccinations running just below 3m doses per day and over 75 per cent of those 65 and older having received at least one dose,” added economists at Citigroup. “Warmer weather is also contributing.”

In addition to the vaccine programme, investors and analysts have also said the Biden administration’s $1.9tn fiscal stimulus programme has added further fuel to the powerful Wall Street equities rally that followed the coronavirus-triggered stock market lows last March.

US government bonds, which unlike equities were open on Friday, came under pressure at the end of last week as investors continued to amplify their expectations for a vigorous economic recovery. The benchmark 10-year yield finished Friday at 1.72 per cent, not far from a recent high above 1.77 per cent. The yield was little changed on Monday.

Investors are now looking forward to a massive infrastructure spending scheme pitched last week by Joe Biden. The president has indicated that this round will be partially funded by increased taxes on US corporations, something expected to place downward pressure on profits.

In commodities markets, oil prices declined. Brent, the international benchmark, fell 1.7 per cent to $63.73 a barrel, while US marker West Texas Intermediate slipped by around the same margin to $60.42.

Elsewhere, Japan’s Topix index rose 0.6 per cent while South Korea’s Kospi advanced 0.3 per cent. Markets in China, Hong Kong, the UK and most of Europe were closed for holidays.

"peak" - Google News

April 05, 2021 at 06:36PM

https://ift.tt/31OFads

Wall Street set to rise after last week’s S&P record peak - Financial Times

"peak" - Google News

https://ift.tt/2KZvTqs

https://ift.tt/2Ywz40B

Bagikan Berita Ini

0 Response to "Wall Street set to rise after last week’s S&P record peak - Financial Times"

Post a Comment