This video can not be played

To play this video you need to enable JavaScript in your browser.

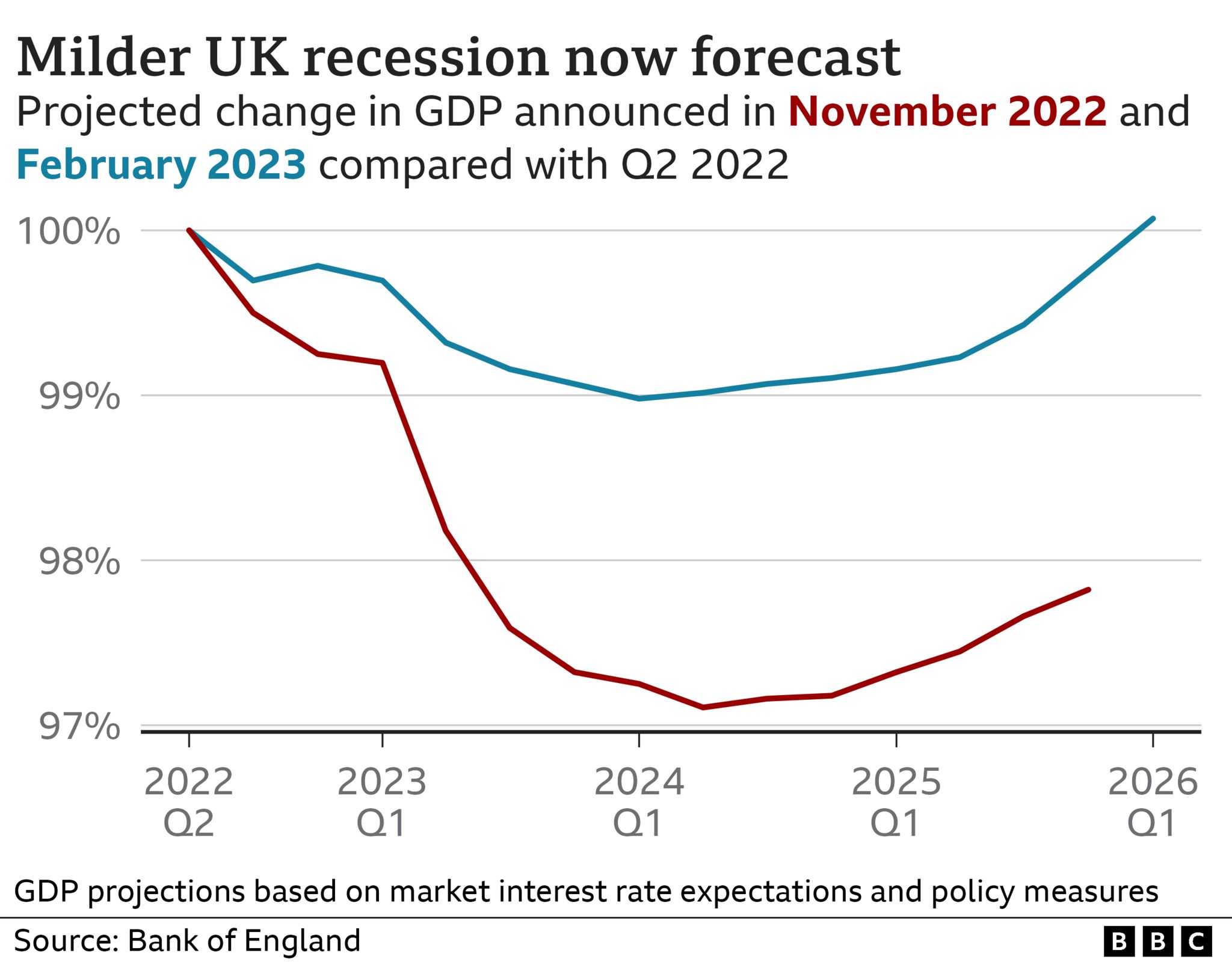

The UK is set to enter recession this year but it will be shorter and less severe than previously thought, according to the Bank of England.

The slump is now expected to last just over a year rather than almost two as energy bills fall and price rises slow.

As a result fewer people are likely to lose their jobs, but the economy remains fragile, warned the Bank.

The forecast comes as interest rates were raised to 4% from 3.5%, their highest level in over 14 years.

The Bank has been putting up interest rates in a bid to tackle the soaring cost of living.

Inflation, the rate at which prices rise, remains close to its highest level for 40 years - more than five times what it should be.

Bank governor Andrew Bailey said inflation now appears to be falling, but warned there are still "big risks out there" which could continue to have an impact on the economy.

On Thursday, the Bank suggested interest rates may be nearing a peak, indicating it will only raise rates further if it sees signs that inflation will remain high.

However, the country is not forecast to bounce back to pre-Covid levels until 2026, which Mr Bailey said was "extraordinary".

"Covid has had bigger long-run effects than we thought it would, particularly in terms of things like the labour supply and people choosing to come out of participating in the labour force."

Higher interest rates are meant to encourage people to save more and spend less, helping to stop prices rising as quickly.

Thursday's hike in borrowing costs is the tenth in a row and will add pressure to many households already struggling with the cost of living.

The impact will be felt by borrowers through higher mortgage and loan costs, although it should also mean better returns for savers.

Homeowners with a typical tracker mortgage will now pay about £49 more a month. Those on standard variable rate mortgages face a £31 increase.

The Bank's predictions come after a separate forecast from the International Monetary Fund (IMF) suggested the UK would be the only major economy to shrink in 2023, performing worse than even Russia.

It is slightly more pessimistic than the IMF and it said that the UK economy would be weak for some time.

The UK has a record 1.1 million job vacancies while the number of people classed "economically inactive" - which is people aged between 16 and 64 not looking for work - has risen.

Mr Bailey said that in most countries, the number of economically inactive workers had fallen since the height of the pandemic, but this was not the case in the UK.

"That is what marks the UK out," said Mr Bailey.

How is the rising cost of living affecting you? Get in touch.

- Email haveyoursay@bbc.co.uk

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Please read our terms & conditions and privacy policy

The Bank previously expected the UK to fall into recession at the end of last year, with the downturn lasting until the middle of next year. It now expects the slump to be shorter - starting in the first three months of this year and lasting until the end of March next year.

A recession is defined as when the economy shrinks for two consecutive three-month periods. Typically companies make less money and cut jobs, leaving the government with less tax revenue to spend on public services.

The Bank is now predicting:

- The economy will shrink by 1% versus 3%, largely because "wholesale energy prices have fallen significantly."

- The unemployment rate will peak at 5.3% rather than 6.4%. It is currently 3.7%.

- Inflation will fall back to 8% in June before dropping further to 3% by the end of the year.

- If workers get big pay rises it could lead to a slower fall in inflation.

'I've docked my wage and reduced opening hours to cut costs'

Business owner Jo Williams is worried about the extra costs of an interest rise for her bed sales company and gift shop in Nuneaton.

The mortgage costs for the bed shop warehouse has gone up by £150 per month and her own home mortgage is also creeping higher.

To make up those losses, Jo has cut opening times from 9.30am to 5pm to 10am - 4pm and for the first time in 8 years, has made one member of staff redundant.

"We tried everything to secure that job but it's a case of having to keep a very, very close eye on cash flow right now," she explained.

Chancellor Jeremy Hunt said the government would act in "lockstep" with the Bank to tackle inflation. This meant resisting the urge "to fund additional spending or tax cuts through borrowing, which will only add fuel to the inflation fire".

But Labour's shadow chancellor Rachel Reeves said: "The reality is that under the Tories growth is on the floor, families are worse off and we are stuck in the global slow lane."

"severe" - Google News

February 03, 2023 at 01:12AM

https://ift.tt/vjuVEJz

Bank of England says recession expected to be shorter and less severe - bbc.co.uk

"severe" - Google News

https://ift.tt/ijsb9B1

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Bank of England says recession expected to be shorter and less severe - bbc.co.uk"

Post a Comment